For many, hearing the words “insurance qualifying event” brings changes that impact healthcare coverage to mind. Having a baby, a change in marital status, or moving to a new zip code are just a few examples.

When it comes to your auto and home insurance, you should be giving them a bit more thought in your day-to-day life, especially since it could save you money in the long-haul.

Here are times when it might make sense to review your coverages to make sure you, your loved ones, your home and your prized belongings are safeguarded.

Renewal

First and foremost, a perfect time to review your coverages is when it’s time for your policy to renew. Start the new policy period on the right foot, with the right protection.

Think about your life over the past 6 months or year and reflect. Do you need more or less coverage somewhere? What are your limits? Are there optional coverages you may now want to include, or are there any discounts you aren’t taking advantage of?

Car Changes

It’s common knowledge that you have to update your insurance if you change the car you drive. Whether you buy a new car, score a great deal on a used vehicle, or sell one due to lifestyle changes, you have to let your insurance provider know. During that process, it’s an opportune time to make sure your car insurance coverages are right for your new driving situation.

But there are more times you may want to be updating your policy. For instance, if someone becomes a new driver in your household, or if someone stops driving altogether, you’ll want to review your coverages and make any necessary changes.

Additionally, if you make changes to your car that increase its value, it may make sense to up your protection, since it’ll be more expensive to repair. Not to mention, certain vehicle safety enhancements could grant you a car insurance discount, depending on your provider.

Lifestyle Changes

Your life changes frequently, so your insurance should stay adaptable and grow with you, too. Are you or someone in your household now working remote, or starting to go back into an office more regularly? Is retirement coming up? Are you on the road more due to new caretaking duties, or something else?

Whatever your situation, think about your lifestyle and whether it’s changed. If so, it may make sense to review your coverages to make sure you have enough of what you need, for when you might need it.

Home Updates

Moving impacts your home and car insurance, so while it may be obvious that you have to let your insurance provider know, it makes sense to do more than just give them a heads up.

Even if you didn’t move, if you’ve made major home improvements such as a kitchen reno or updates to reduce your carbon footprint, it’s a good idea to review your policy and check that you have enough protection. Insurance could even cover something as seemingly minor as a delivery driver ruining a prized shrub in your driveway. If your home now costs more to repair or replace, you’ll want to make sure your home insurance coverage reflects that.

Some providers even offer home insurance discounts if you add certain safety features to your home or make it more eco-friendly.

Shopping & High-Value Items

We all deserve to treat ourselves. And sometimes, we have the opportunity to go big! Whether it’s with an expensive new watch, professional camera or original artwork, investing in big-ticket items is something that is often thought about for a while. But, insuring them isn’t necessarily top of mind.

Making sure your high-value items are protected could save you money in the long-run if they are even damaged or stolen. And, it will give you peace of mind to enjoy them without any nerves or apprehension.

Most standard home insurance policies offer limited coverage for jewelry or other valuable items, often not enough to come close to the cost of replacing them. But you can purchase additional coverage to extend your protection for your lost or damaged belongings, such as:

- Jewelry

- Fine Arts

- Silverware, Fine China and crystal

- Cameras

- Computers or other tech

- Musical instruments

Weather Patterns

Have you noticed a shift in the weather over the last five years, or even past few seasons? Have there been more intense thunderstorms, hurricanes or wind? Is there more snow or freezing temps in the winter?

It’s important to keep note of any drastic weather or natural disasters in your area, and if any patterns have changed over time. If more and more frequently, you are noticing tree limbs in your yard, it’s probably wise to make sure you have coverage in case one ends up on your shed or car.

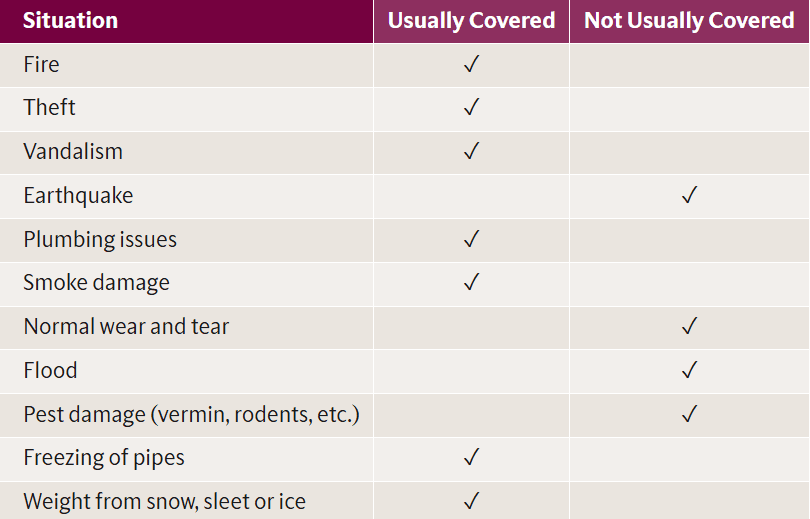

Just remember, home insurance doesn’t cover general wear and tear, and most standalone home insurance policies don’t offer earthquake or flood coverage. You will need to buy separate policies to get the protection you need. Check out our table below for what is and isn’t typically included in a standard home insurance policy.

Wellness Routine

What does your wellness routine look like? Wellness covers anything from keeping up with doctor’s appointments to budgeting. Some of us may enjoy regular exercise classes or quarterly meetings with a financial planner. Wellness can look different for everyone, but at the end of the day it’s prioritizing the things that keep you safe, happy and protected. Reviewing your insurance coverages should be treated no differently. While you don’t need to do it every week, thinking of it as a wellness habit to introduce to your self-care routine is a great way to start.

Always enjoy reading what’s going on in the world. Thanks

I am trying to find out what my deductable is. I see commercials for AARP auto policies that mention a disappearing deductable. I can’t find anything in what is supposed to be my policy that mentions a deductable at all.

Haven’t found a phone number yet to ask a question.

Hi Joel! The Hartford is happy to help. Please call our representatives at 800-423-6789 who can help your with your inquiry. Thanks for reading Extra Mile!