With age, people accumulate not just memories and wisdom, but also resiliency and confidence. Sometimes, even a deeper appreciation for the unexpected. Many of us have lived through storms, both literally and figuratively.

Yet when it comes to natural disasters, it can be easy to fall into the trap of thinking, “That won’t happen to me.” But the scary reality is, it could.

Natural disasters can create unique challenges for older adults. Mobility limitations, medical needs or a limited support system can all influence the ability to evacuate and then to recover after a storm. That’s why planning ahead is not just wise—it’s essential.

Natural disasters can be traumatic, but having a plan can help to reduce stress. Planning isn’t about fear, but rather empowerment and making sure that if the unthinkable happens, you’re ready—not just to survive, but to recover and thrive.

The ABCs of Natural Disaster Planning — Action, Belongings, Connections

Disaster planning doesn’t have to be overwhelming or frightening. It can be a thoughtful process that draws on a lifetime of experience and leaves you feeling ready for whatever may come your way.

Action: Take It

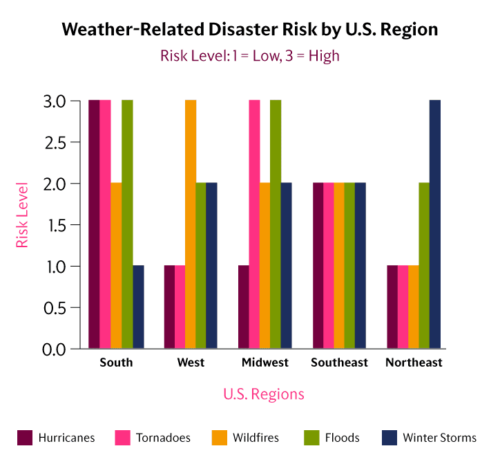

Start by understanding the risks in your area. Are you in a flood zone? Near a fault line? Being aware of the most common disasters in your region* is key to being well-prepared.

Then, control what you can control. Not sure where to start? Tips include:

- Create a disaster kit with essentials like water, medications, flashlights, and important documents.

- Plan your evacuation route and know where local shelters are.

- If you rely on medical equipment or have mobility challenges, make special arrangements.

- Talk to your doctor about emergency prescriptions.

- Arrange transportation with neighbors or family if you can. If that isn’t possible, consider contacting your local Area Agency on Aging, as they may have transportation resources available.

- Don’t forget your pets—have a plan for their care too!

- Review your insurance policy. Are you protected against flood, earthquake or sump pump failure? Do you have replacement cost or actual cash value? Do you have enough coverage for valuables or safety upgrades? (Bonus: you may be able to get a discount on those.) Fully understanding your policy will help you enjoy confidence knowing you’re covered.

Belongings: Document Them

After a disaster, your insurance company will ask for a list of damaged or lost items. A home inventory—photos, videos, or written lists—can make this process much easier. Start small by taking pictures of each room, open drawers and closets, and document valuable items. Store this information in a safe place, like a cloud service if using a smart phone or a trusted friend’s home if the items are not digital.

Connections: Make Them

Ideally, no one should face a disaster alone. Build a support network of family, friends, and neighbors. Having social connections not only can provide support in tough times, but can also increase your sense of belonging and reduce loneliness. Plan to talk about your plans and ask for help where needed. If possible, identify someone outside your area who can be a central contact during emergencies.

Knowing who you can count on brings peace of mind, while preparation gives you control in what can be a chaotic situation.

Taking these practical ‘ABC steps’ toward preparedness, can turn anxiety into action and may even provide some sense of calm before a potential storm.

After the Event — Insurance, Recovery, and Resources

The storm has passed, but in some instances, the journey has just started. Recovering from a disaster can be daunting—but with the right knowledge and support, it’s manageable. It’s important to think about how you will work with insurers, avoid scams and access resources.

1

First Steps

Safety comes first. Once you’re secure, contact your insurance company. Provide details about the damage and an alternate contact number. If you’ve created a home inventory, now’s the time to use it. It will help your adjuster assess your claim quickly and accurately.

Prevent further damage if it’s safe—cover broken windows, remove debris and save receipts. Don’t start permanent repairs until your adjuster approves them.

2

Navigating the Claims Process

Be cautious about contractors. After disasters, unlicensed workers often inundate impacted areas. Ask your insurer for recommendations and check credentials. If you delegate claim responsibilities to a family member, choose one person to streamline communication.

At The Hartford, our priority is to help you restore your home and peace of mind as quickly and efficiently as possible. If you’re insured by us, you can call 800-243-5860 or visit the online claims center to file a claim. We will contact you within one business day to assess your needs, answer your questions and provide service options.

3

Additional Resources

Organizations like FEMA, the Red Cross, and Ready.gov offer guidance and support in advance of and after a natural disaster. In addition, The Hartford’s Guidebooks are tailored specifically for 50+ consumers, offering insights and tips for a variety of circumstances.

With preparation, patience, and support, you can rebuild your home—and your peace of mind.

*

Robinson, B. (2025, February 4). New study identifies at-risk states for natural disasters in 2025. Forbes. https://www.forbes.com/sites/bryanrobinson/2025/02/04/new-study-identifies-at-risk-states-for-natural-disasters-in-2025/

Federal Emergency Management Agency. (n.d.). National Risk Index. U.S. Department of Homeland Security. https://hazards.fema.gov/nri/map

National Center for Disaster Preparedness. (2025). Research and preparedness tools. Columbia Climate School, Columbia University. https://ncdp.columbia.edu/