Your home may be the single largest asset in your life and ensuring you have the right home insurance coverage to protect this important investment may make the difference between minor disruptions and devastating financial losses.

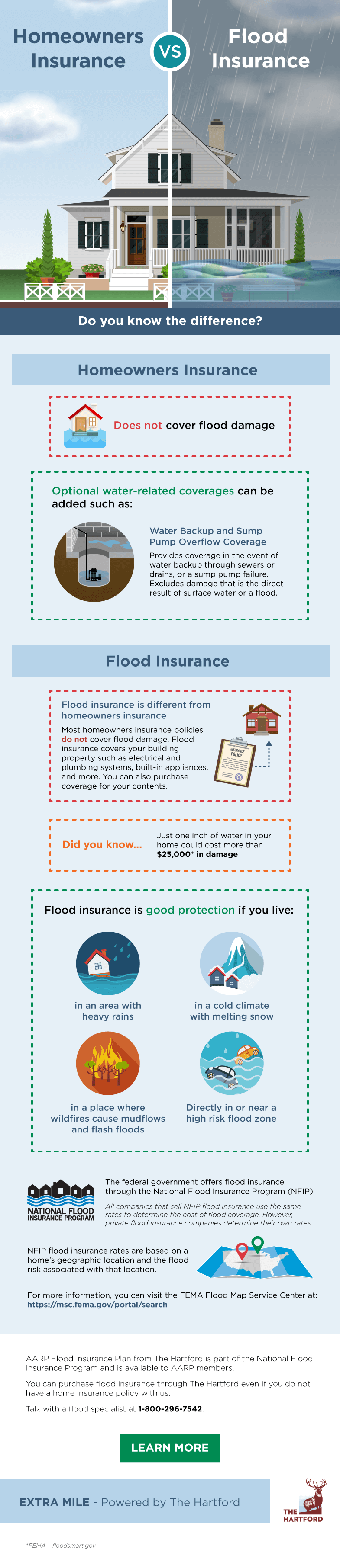

A standard homeowner’s policy will provide basic coverage and may reimburse your losses from several causes, such as fire, theft, and water damage due to broken pipes but it won’t pay for flood damage.

If your home is in a region that is susceptible to water damage from sources such as melting snow, overflowing of nearby bodies of water, heavy rains, or even wildfires, it may be a prudent decision to add an extra layer of protection in the form of flood insurance offered through the National Flood Insurance Program (NFIP).

Understanding the differences between home insurance and flood insurance can be confusing; we’re here to help simplify the comparison so you can make sure you have the right coverage for your specific situation.

Be Prepared! Use these 6 tips to help prevent and reduce flood damage to your home.

Absolutely, helpful! Thankful for these tips and will be sure to apply this to our insurance!

I’m interested in Home Insurance with The Hartford, having just moved my auto insurance to you via AARP.

Reinhold – Thanks for being a new auto customer. It’s a great idea to bundle your home and auto insurance. For a quote, please contact Customer Service at 800.423.0567.

INFORMATION ABOUT FLOOD INSURANCE

Hi Kenneth- you can learn more about flood insurance here.